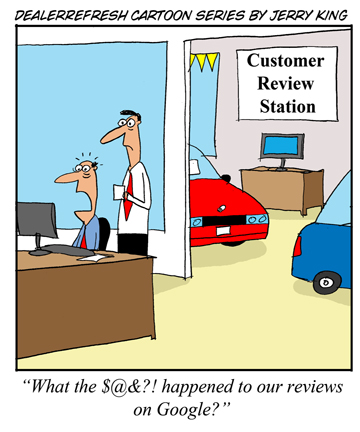

What has happened to all those Google reviews?

Are review stations at the dealership (despite Google initially saying it was Okay) the culprit?

If you’ve never read this thread that Ed Brooks started months ago over in the forums, I would encourage you to do so – “Mike Blumenthal on Onsite “Review Stations” and Google”

Additional threads around reviews and Google.

- Google Reviews Disappeared!?!?!? What’s the deal?

- Dealers flooding review sites with fake user reviews

Founder of DealerRefresh - 20+ Years of dealership Sales, Management, Training, Marketing and Leadership.