Cause and effect. This is a simple model to apply to solve problems.

Cause and effect. This is a simple model to apply to solve problems.

What factors that we can control influence outcomes in our life, our business, or our job/role.

Let’s take a look at Used Cars.

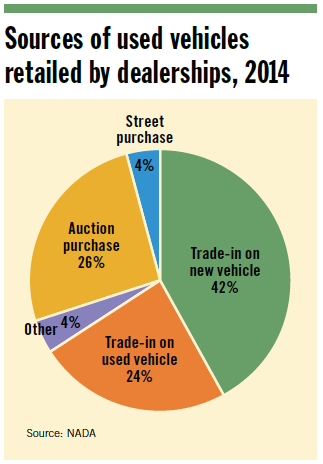

Where do Used Cars come from?

Owners, of course. There is no used car manufacturer. Of course, the auction or other wholesale dealer-to-dealer channels can account for some.

But, did you know that nearly 70% of used vehicle sales by dealers came from direct-from-consumer transactions? To be exact, in 2014 66% of all used cars retailed by dealers were sourced from trade-in.

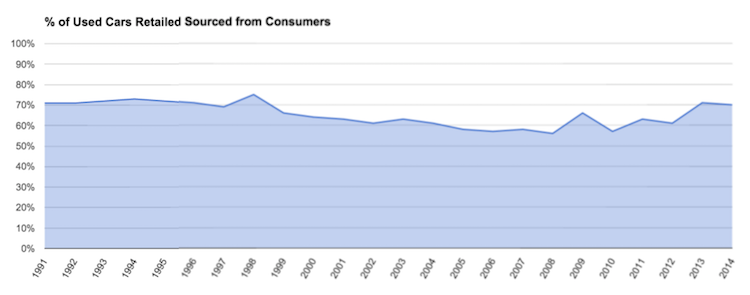

How has that number changed over the years?

Well, here is the same % of source of used cars retailed for trade-in and street purchase over the previous 10 years:

I speak with many dealers on a regular basis, they ALL say they would love to improve their New to Used sales ratio.

I speak with many dealers on a regular basis, they ALL say they would love to improve their New to Used sales ratio.

So what do you think?

I contend that if you want to sell more used cars then buy more. To buy more, you need to have more conversations with prospects about their car. Your own dealer website can be a tremendous source of these particular conversions. Even Tesla recognizes the importance of these conversations.

In order to have more conversations, we need to get in front of more prospects and it needs to be easy.

Take a moment and place yourself in the consumers seat, now go on your own dealer website and step through the process (if you have an online trader-in tool) of obtaining a “trade-in value”, just as a consumer would…

How long did it take?

How many clicks did it take?

Was the returned value transparent? (where did the value come from?)

How was the overall experience?

Now do the same on your Phone…

How long did it take?

Was it easy to do on your phone?

Could you even accomplish it on your phone?

Potential customers are all over your dealership website each day. Most of these customers have a vehicle to trade; a conversation to have. Studies and surveys have shown when visiting a dealer website, researching the value of their trade-in is in the top 3 areas of information they are seeking. Yet, many dealers make it difficult to obtain this information. And when the consumer does finally get to the end of the process, they are presented with a value that provides little to no transparency to where it came from. Making it extremely difficult to even start a conversation.

Cause and effect…

What can you do to improve and increase the number of conversations you’re having for acquiring more trade-ins.?

Current Discussion Topics