Your Sales Manager is at the auction. Rows of vehicles are lined up, one after the other. He’s done this long enough to have picked out the ponies from the dogs.

There is one beauty sitting there. It’s clean. Appealing to the eye. A good model and one that his inventory market appraisal tool says will have a reasonable margin on it. He makes his move and wins the bid.

A success, by his standards. It shows up on the lot, goes through inspection and detail. It’s spotless – a great choice.

And then it sits on the lot.

And sits…

And sits…

And sits…

Has this ever happened to you?

How many times a month?

There is a quintessential breakdown occurring that no one is talking about. Yet they should be. The connection between book value, margin, available inventory in market, and turn are no longer the chief variables in which you should be acquiring inventory.

Online Search Volume (OSV)

Supply and demand has always been a moving target. A multitude of factors affect it: from manufacturers over supplying cars to a large number of vehicles coming off lease to vehicles that have a bad rap from a recall. It used to be that you could go to Kelley Blue Book or the Black Book to find out the valuation of a vehicle — it was a tough game but it could be done with just a book in hand. At the end of the day, a seasoned dealer would know enough about the ebb and flow of the market to make it work.

With the Internet, the landscape has changed and the once tried-and-true go-tos just can’t keep up with the real-time pace of supply and demand. The market moves too quickly and their valuations become out of sync. That leaves you with a bunch of cars on your lot that don’t sell.

So what are you supposed to do?

Enter: Online Search Volume (OSV). What people are searching for online will have a greater impact in the margin and turn, more than what is actually available for sale on lots. And OSV changes regularly, so it’s not about what is out there in the market. It’s about what the market is looking for.

What does that mean for you?

For four months beginning in November 2015, CarStory conducted analysis on the three best used deals (on average by make and model) in 20 DMAs across America and found that, by and large, dealers are offering deep discounts on used vehicles that typically aren’t being searched for online by consumers. The OSV might be the single most important factor in vehicle valuation.

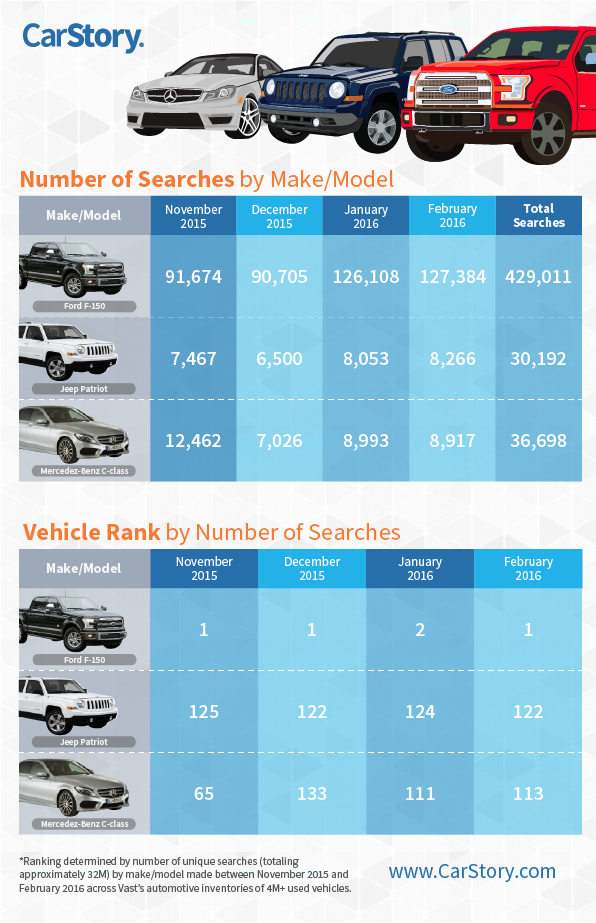

Taking into account regional variations, we found that, overall, the vehicles with the deepest discounts were the Jeep Patriot and Mercedes-Benz C- class, making their ‘book values’ completely out of step with reality. For example, in Los Angeles, the Mercedes-Benz C-class sells for an average of $5,000 less than what we’d expect, while the Jeep Patriot is selling for an average of $4,000 less. Unsurprisingly, the Jeep Patriot never breaks into the Top 100 used cars consumer searches and the Mercedes Benz C-class only does so in November at #65 (according to search data culled from over 8 million searches a week for four months.)

For reference, let’s compare that with the Ford F-150— which ranks #1 and #2 during our four month period.

The REAL Impact of OSV

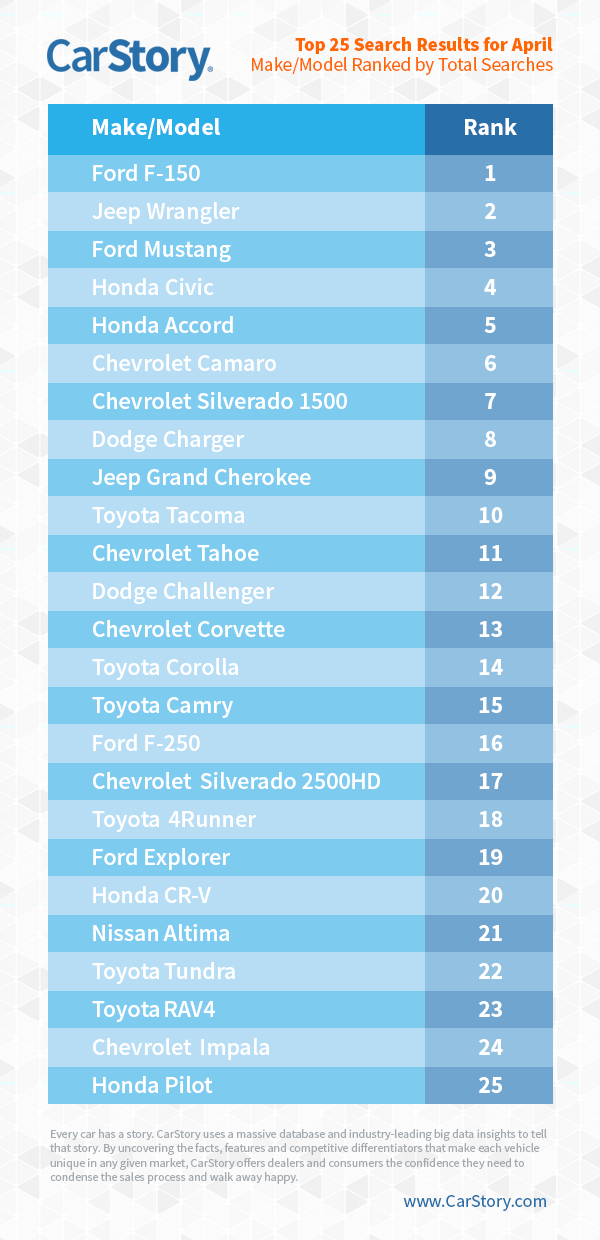

Our market reports analyze data from over 32 million searches across 4 million used vehicles listings, and have consistently shown each month the Jeep Wrangler and Ford F-150 in the top two spots among a wide array of other domestic makes/models. Honda is the only import to consistently make the top ten with their popular Civic and Accord models.

The Ford Mustang also consistently ranks in the top 5 searches. And, unsurprisingly, none of these vehicles show up in our list of top three deals in any DMA. It’s simple economics: if the market wants it, there’s no reason to discount it.

Because of how regularly OSV changes, it’s become one of the only reliable indicators of market interest. It’s invaluable if you want to move cars off the lot quickly – it’s even more important in discovering which cars will be the most profitable to your bottom line.

You need to consider the actual Online Search Volume (OSV) before you take a flyer on a vehicle acquisition. At the end of the day, it’s what will tell you what you really need to know about a car … when Kelley Blue Book can’t.