Yes, by traditional standards I was considered an early adopter. I tend to be one of the first to embrace a technology that permits me more efficiency on the go. Smartphone? I had one of the originals – a massive Handspring Treo 300. The year was 2002 – your PC was based on a Pentium processor and James Bond’s iconic BMW Z3 was still in production.

I’ve been using a smartphone for over a decade. Whether that makes me innovative or dangerously close to a Star Trek bedroom set is your call. My first smartphone was large and closer in size to the iPad mini than a current mobile phone. However, despite the size, myself and other early-adopter business pros couldn’t go back. It went quickly from a want to a need. It was the convenience, power, and ability to get things accomplished on the go.

Wait, you understand. A recent study found that more people would rather lose their wallet than lose their smartphone. I think this speaks volumes of how precious our mobile devices have become in today’s society.

Over 110 million in the US have a smartphone. My article on Nielsen smartphone data shows just how fast the revolution is moving. Not only is there a growing number of smart phone purchasers in US, but their usage behavior is more in line with early adopter tendencies than ever before. They’re willing to upgrade and place a priority on having the latest features.

I’m writing this one month after the iPhone 5 and iOS 6 launch. Let’s look at some staggering numbers.

In 2001, one year after Windows XP was launched only 14% of users had upgraded to the latest Microsoft software offering.

In the first month over 60% of iOS users have upgraded to iOS 6 – a month old operating system with well-documented issues and bugs common to new software releases. That’s tens of millions people willing to risk the functionality of a device more important than their wallets so they can have the latest.

Today’s early adopters are not the fringe, they are becoming the majority.

Your mobile customer is an early adopter and a recent Nielsen study helps define their behavior.

1. Mobile car shoppers aren’t just young and techy

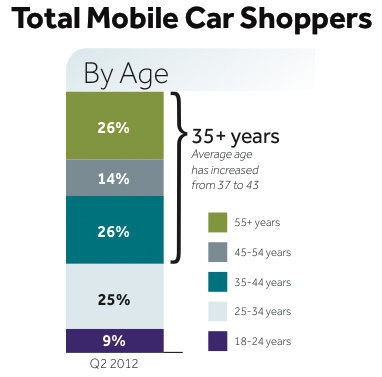

Of Nielsen’s survey the average age of mobile car purchasers and intenders was 43. Further, a full 66% of those surveyed were over the age of 35. In fact, 26% of this grouping was made up of individuals over the age of 55.

2. Mobile: Not just high-end purchasers

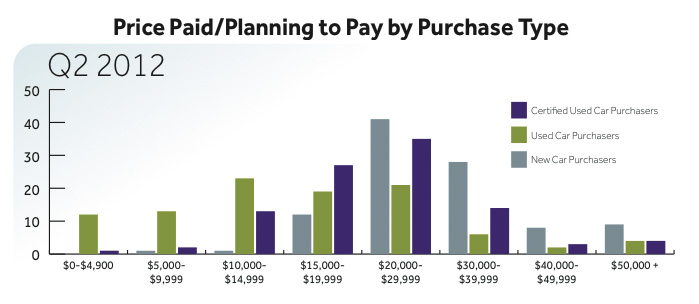

The study finds that among new car purchasers, the majority “paid price or planning to pay price” was between $20k and $40k. Used car purchasers cited the $10k to $15k range most, with certified used car purchasers/intenders one bracket up at $15k to $20k.

3. Shoppers prefer mobile close to time of purchase

The study found that while computers, tablets, and smartphones were used in all stages of the purchase process, different devices were used more commonly in certain phases. Desktops/laptops were favored early in the process during the research phase while mobile was more often tied to activities closer to the purchase stage.

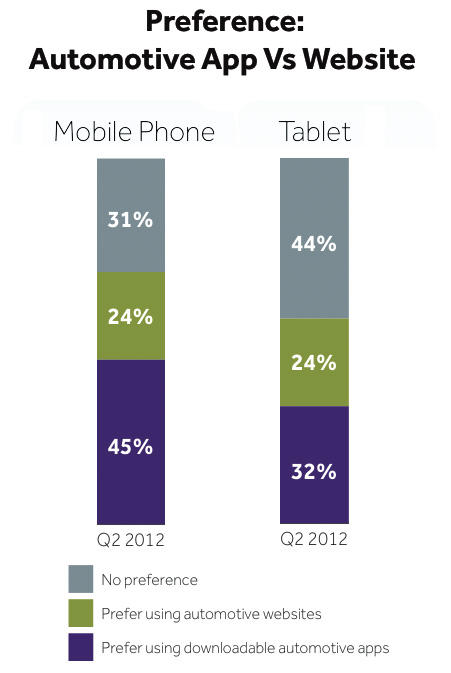

4. Mobile Apps vs. Mobile Sites

Interestingly the study found that among shoppers that used both websites and apps in their purchase process, nearly double those surveyed preferred apps over websites when using a mobile phone. The study found that shoppers used apps most for contacting or locating a dealership, sharing aspects of the shopping process, and writing reviews.

5. Dealership apps / mobile sites influence dealer selection

The study found that nearly 2/3rds of intenders had narrowed down their dealership choice since they first accessed an automotive website or app from their device. This is one of the most interesting finds in the study. After using their mobile device, two thirds of intenders had made the decision from which dealership to purchase their vehicle!

In summary, your customer is increasingly utilizing mobile during their automotive shopping experience. They’re not afraid of using new tools to enhance their shopping efficiency.

What steps has your dealership taken to create a mobile marketing strategy?